Table of Contents

- Executive Summary: Key Findings & Market Highlights

- Technology Overview: Fundamentals of Zirconium Vapor Deposition

- 2025 Market Landscape: Major Players & Industry Structure

- Cutting-Edge Innovations: Recent R&D and Breakthrough Processes

- Application Analysis: Aerospace, Energy, Medical, and Electronics

- Competitive Analysis: Leading Companies and Strategic Moves

- Regional Insights: Growth Hotspots & Global Demand Outlook

- Market Forecast 2025–2030: Revenue Projections & Trends

- Sustainability and Regulatory Developments

- Future Outlook: Emerging Opportunities and Challenges Ahead

- Sources & References

Executive Summary: Key Findings & Market Highlights

Advanced zirconium vapor deposition technologies are experiencing significant advancements as of 2025, reflecting increased demand from aerospace, nuclear, medical, and electronics industries. The global push for improved material performance—especially in high-temperature, corrosive, or high-stress environments—has accelerated the adoption and innovation of both chemical vapor deposition (CVD) and physical vapor deposition (PVD) processes for zirconium-based coatings and films.

Key industry leaders are expanding their offerings and capacity. ATI and Plansee SE have reported investments in next-generation vacuum deposition equipment, emphasizing tighter process control and scalability for zirconium alloys and pure coatings. These advancements address critical needs in turbine blades, nuclear reactor cladding, and biomedical devices—applications demanding extreme reliability and corrosion resistance.

Recent developments include the integration of advanced plasma-enhanced techniques, such as high power impulse magnetron sputtering (HiPIMS), allowing for denser, smoother, and more adherent zirconium coatings. Companies like Ionbond are actively commercializing such technologies, reporting improved coating performance and throughput, which is crucial for cost-sensitive sectors like automotive and electronics.

Another significant trend in 2025 is the move toward digitalization and automation of vapor deposition processes. Leading equipment manufacturers, including ULVAC and Veeco Instruments Inc., are integrating Industry 4.0 principles, deploying real-time process monitoring and predictive maintenance tools to optimize productivity and yield, particularly for high-value zirconium thin films.

Sustainability and resource efficiency are also at the forefront. Several suppliers are developing closed-loop recycling systems for zirconium precursors and waste, reducing environmental impact and addressing regulatory pressures. Partnerships between zirconium producers and deposition equipment suppliers are expected to accelerate the commercialization of such solutions through 2027.

- Significant investments in advanced CVD and PVD processes are enabling superior zirconium coatings for extreme environments.

- HiPIMS and plasma-enhanced deposition technologies are delivering enhanced coating quality and process efficiency.

- Automation, digitalization, and process analytics are optimizing yields and ensuring consistent product quality.

- Resource recycling and sustainability initiatives are gaining momentum across the zirconium vapor deposition value chain.

Looking ahead to the next few years, the outlook for advanced zirconium vapor deposition technologies remains robust, with further innovation expected in process control, material efficiency, and tailored coating solutions for emerging applications.

Technology Overview: Fundamentals of Zirconium Vapor Deposition

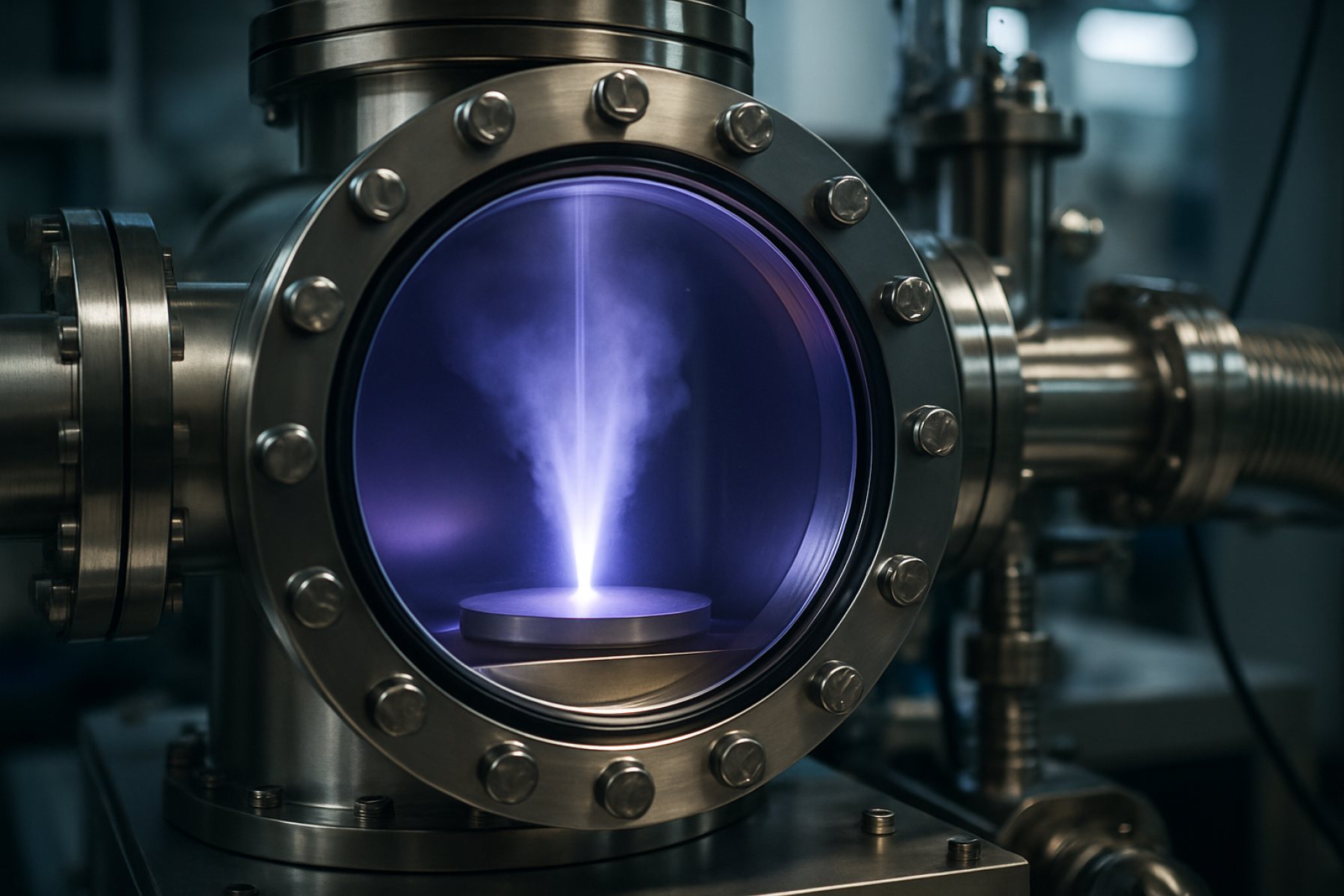

Zirconium vapor deposition technologies have evolved considerably, driven by demand for advanced coatings in the nuclear, aerospace, and biomedical sectors. As of 2025, the field is characterized by ongoing innovations in both physical vapor deposition (PVD) and chemical vapor deposition (CVD) techniques. These processes enable the formation of highly pure, corrosion-resistant, and mechanically robust zirconium coatings on a broad array of substrates.

Traditional PVD methods, such as electron beam evaporation and magnetron sputtering, remain widely used due to their ability to deposit high-purity zirconium films with precise thickness control. Leading industry manufacturers, including Atos and Tosoh Corporation, continue to optimize these systems, incorporating advanced plasma generation and in-situ monitoring for improved film uniformity and process reproducibility. Notably, multi-target sputtering systems developed by ULVAC, Inc. are enabling the deposition of zirconium-based alloys and multilayer structures, which are of increasing interest for tailored functional coatings in high-performance engineering applications.

Recent breakthroughs in CVD processes focus on reducing deposition temperatures and improving coating adhesion, making them suitable for more temperature-sensitive substrates. KYOCERA Corporation and H.C. Starck Solutions have reported the integration of low-pressure and plasma-enhanced CVD systems capable of producing dense, conformal zirconium films with enhanced corrosion resistance, particularly for nuclear fuel cladding and medical implant technologies. These advancements are complemented by improved precursor delivery systems and real-time analytical tools for controlling film stoichiometry and microstructure.

A significant trend in 2025 is the push towards sustainability and resource efficiency. Manufacturers such as Plansee are investing in closed-loop recycling and recovery processes for zirconium targets and precursors, aiming to reduce waste and environmental impact. Additionally, digitalization and process automation—including machine learning-assisted deposition parameter optimization—are being implemented to maximize throughput and yield while minimizing human intervention.

Looking ahead, the next several years are expected to see further integration of hybrid deposition technologies (combining PVD and CVD), expansion into additive manufacturing for customized zirconium-coated parts, and the scaling up of production capabilities to meet growing demands from energy, defense, and medical sectors. The sector’s outlook is marked by increasing collaboration between equipment manufacturers, materials suppliers, and end-users to accelerate technology transfer and application development.

2025 Market Landscape: Major Players & Industry Structure

The 2025 market landscape for advanced zirconium vapor deposition technologies is shaped by a combination of established industry leaders, emergent innovators, and a competitive supply chain that spans multiple continents. The primary applications of zirconium vapor deposition include nuclear fuel cladding, biomedical implants, aerospace coatings, and high-temperature electronics, all of which are driving demand for more refined and efficient deposition processes.

Key players in this field include Praxair (now part of Linde plc), which continues to expand its vapor deposition materials portfolio for both research and industrial-scale applications. Tosoh Corporation is also a significant supplier of high-purity zirconium compounds, supporting both physical vapor deposition (PVD) and chemical vapor deposition (CVD) technologies for coating applications. Meanwhile, ATI (Allegheny Technologies Incorporated) maintains a strong position in supplying zirconium alloys and targets for the vapor deposition process, especially for aerospace and nuclear sectors.

In Asia, Chepetsky Mechanical Plant (part of TVEL, a ROSATOM company) is a leading producer of zirconium and its alloys, with integrated capabilities for producing vapor deposition materials that meet stringent nuclear industry standards. China National Nuclear Corporation (CNNC) and its affiliates are also ramping up capacity for zirconium processing, aiming to localize supply chains for advanced deposition techniques in the Chinese nuclear and electronics sectors.

On the technology front, 2025 is marked by continued investment in process optimization and scale-up. Companies are focusing on improving deposition uniformity, reducing impurity levels, and increasing throughput. For instance, ULVAC and Oxford Instruments are enhancing their vacuum deposition equipment portfolios to enable more precise control over thin zirconium coatings, targeting both R&D and volume manufacturing markets.

The industry structure in 2025 is characterized by vertical integration among major suppliers, close collaborations between material producers and deposition equipment manufacturers, and increased R&D investment in partnership with end-users in nuclear, medical, and aerospace fields. The outlook for the next few years includes further geographic diversification of supply, greater emphasis on sustainability in process development, and heightened competition as emerging players in South Korea and India seek to enter the global market.

Cutting-Edge Innovations: Recent R&D and Breakthrough Processes

The landscape for zirconium vapor deposition technologies is witnessing significant advancements in 2025, driven by the demands of aerospace, nuclear, biomedical, and advanced electronics sectors. Recent R&D efforts are targeting higher purity coatings, improved process efficiency, and scalability, with a focus on reducing environmental impact and operational costs.

One of the most notable innovations is the refinement of atomic layer deposition (ALD) and chemical vapor deposition (CVD) processes for zirconium-based thin films. Leading equipment manufacturers are optimizing precursor delivery and plasma-enhanced methods to achieve atomic-level control over film thickness and uniformity. For instance, Applied Materials continues to develop next-generation ALD platforms, enabling precise deposition of zirconium oxide and zirconium nitride for semiconductor and protective coating applications. Such ultra-thin films are critical for gate dielectrics and high-temperature sensors.

In the nuclear sector, zirconium coatings are essential for cladding and corrosion resistance. Recent R&D by Westinghouse Electric Company has focused on advanced CVD techniques to deposit zirconium alloys with enhanced hydrogen embrittlement resistance, extending fuel rod lifecycles and safety margins. These developments are expected to enter pilot-scale production within the next few years, following successful laboratory validations in 2024.

Meanwhile, Linde, a global supplier of industrial gases and process technologies, has been instrumental in developing scalable vacuum and plasma vapor deposition systems for zirconium and its compounds. Their innovations in gas delivery and chamber design are improving deposition rates and minimizing contamination, aligning with stringent quality requirements for aerospace and medical device markets.

On the materials front, research collaborations between universities and manufacturers are yielding new zirconium-based nanolaminates and composite coatings via vapor phase methods. These structures exhibit exceptional hardness and thermal stability, with early-stage commercial adoption anticipated by 2026, particularly in cutting tools and wear-resistant surfaces.

Looking ahead, the outlook for advanced zirconium vapor deposition technologies remains robust. Key industry players are expected to transition breakthrough lab-scale methods into broader industrial adoption. The integration of AI-driven process control and real-time monitoring is also poised to enhance reproducibility and yield, further solidifying zirconium’s role in next-generation high-performance applications.

Application Analysis: Aerospace, Energy, Medical, and Electronics

Advanced zirconium vapor deposition technologies have become increasingly integral across key industries—most notably aerospace, energy, medical, and electronics—in 2025, with further innovation expected in the next few years. These processes, including Physical Vapor Deposition (PVD) and Chemical Vapor Deposition (CVD), provide high-purity, corrosion-resistant zirconium coatings that enhance performance in demanding environments.

In aerospace, zirconium coatings are prized for their high-temperature stability and ability to protect components from oxidation and wear. Leading manufacturers such as Honeywell International and GE Aerospace are increasingly incorporating zirconium-coated turbine blades and engine components to improve fuel efficiency and extend maintenance intervals. The trend is set to accelerate as next-generation propulsion systems demand superior material performance under extreme conditions.

The energy sector, with a focus on nuclear and hydrogen technologies, is another major adopter. Zirconium’s low neutron absorption cross-section makes it ideal for nuclear fuel cladding, a market dominated by suppliers like Westinghouse Electric Company and Framatome. In 2025, advances in vapor deposition have enabled more uniform and defect-free zirconium coatings, addressing industry calls for enhanced safety and fuel longevity. Additionally, as green hydrogen production expands, zirconium-coated components are being developed to resist corrosion in electrolyzers and fuel cells—a direction pursued by companies such as Siemens Energy.

In the medical field, vapor-deposited zirconium coatings are increasingly specified for orthopedic implants and surgical tools, thanks to their biocompatibility and wear resistance. Companies like Smith & Nephew are developing zirconium-coated implants to reduce allergic reactions and improve device lifespans, a trend expected to grow as regulatory bodies tighten requirements for implant materials.

The electronics industry is leveraging zirconium vapor deposition for thin-film capacitors, semiconductors, and corrosion-resistant connectors. Major manufacturers such as TDK Corporation are exploring zirconium-based coatings to improve device reliability and miniaturization, capitalizing on the material’s excellent dielectric properties and stability at micro- and nanoscale.

Outlook for 2025 and beyond points to continued R&D investment, automation of vapor deposition processes, and scaling up for higher-volume applications. The push for sustainability and product longevity across aerospace, energy, medical, and electronics sectors will solidify zirconium vapor deposition’s role as a critical enabling technology.

Competitive Analysis: Leading Companies and Strategic Moves

The competitive landscape for advanced zirconium vapor deposition technologies is intensifying in 2025, as global demand for high-performance coatings in aerospace, nuclear, biomedical, and electronics applications accelerates. Several companies with established expertise in chemical vapor deposition (CVD) and physical vapor deposition (PVD) are driving innovation through strategic investments, technology partnerships, and capacity expansions.

Key Players and Strategies

- Advanced Metallurgical Group N.V. (AMG) continues to expand its specialty metals portfolio, emphasizing high-purity zirconium products for thin-film applications. In 2024–2025, AMG has committed to increasing its R&D spending and modernizing its refining assets to meet the stringent purity and uniformity demands required by semiconductor and energy clients. The company’s focus on vertical integration ensures security of zirconium supply and process control, a strategic advantage as global supply chains face mounting volatility (AMG Advanced Metallurgical Group N.V.).

- Materion Corporation is leveraging its expertise in engineered thin films to offer advanced zirconium-based sputtering targets and specialized coatings. In late 2024, Materion announced new collaborations with OEMs in the optics and medical device sectors, targeting next-generation wear-resistant and biocompatible coatings. The company is also investing in tailored deposition process development to address the needs of miniaturized and high-reliability components (Materion Corporation).

- Sumitomo Electric Industries, Ltd. maintains a strong position in the market through proprietary PVD and CVD technologies, particularly for the electronics and cutting tool industries. In 2025, Sumitomo Electric is scaling up both production and R&D for advanced ceramic and metal coatings, with zirconium-based films playing a crucial role in enhancing thermal and corrosion resistance (Sumitomo Electric Industries, Ltd.).

- Plansee Group, a major supplier of refractory metals and advanced materials, has intensified its focus on precision-engineered zirconium targets and evaporation materials. The company’s 2025 strategy includes expanding its global sputtering target manufacturing footprint and partnering with research institutes to develop next-generation vapor deposition processes suitable for semiconductor and energy storage applications (Plansee Group).

Outlook

The period through 2027 is expected to see continued consolidation, with leading firms investing in smart manufacturing, digital process control, and supply chain resilience. Strategic alliances between material producers and equipment manufacturers are expected to accelerate the adoption of scalable zirconium vapor deposition solutions. Companies with end-to-end process integration and a robust R&D pipeline will likely set the pace for technical and commercial advancement in this field.

Regional Insights: Growth Hotspots & Global Demand Outlook

Advanced zirconium vapor deposition technologies are experiencing dynamic regional growth, driven by escalating demand in sectors such as nuclear energy, aerospace, electronics, and biomedical devices. As of 2025, the Asia-Pacific region—particularly China, Japan, and South Korea—continues to dominate both production and consumption, leveraging robust industrial infrastructure and government-led initiatives targeting high-performance materials. Major players in the region, such as China National Nuclear Corporation and Tosoh Corporation, are investing in expanding zirconium processing and thin-film capabilities to meet domestic and export requirements.

Europe is also emerging as a growth hotspot, bolstered by stringent environmental standards and the push for advanced materials in clean energy and aerospace. Leading companies such as Sandvik and Scheiber are expanding their research and manufacturing footprints, focusing on high-purity zirconium coatings for corrosion resistance and high-temperature applications. The European Union’s strategic emphasis on reducing reliance on foreign critical materials is likely to fuel further investment in zirconium vapor deposition infrastructure through 2027.

In North America, the United States maintains a strong position, propelled by ongoing Department of Energy initiatives and the presence of established players like Westinghouse Electric Company and Praxair (now part of Linde plc), which are integrating advanced vapor deposition techniques to enhance zirconium alloy performance in nuclear fuel and specialty applications. The region is expected to see stable growth, particularly as next-generation reactor designs and medical implant technologies gain traction.

Middle Eastern markets, while currently smaller, are demonstrating growing interest, especially in the context of nuclear energy diversification and the development of indigenous materials supply chains. Investments in R&D and pilot-scale vapor deposition facilities are being observed in the UAE and Saudi Arabia, with a focus on supporting nuclear and high-tech manufacturing sectors.

Globally, demand for advanced zirconium vapor deposition technologies is forecast to increase at a steady pace, with market participants prioritizing process optimization, sustainability, and application-specific innovation. The coming years will likely see intensified competition for supply security and vertical integration, particularly as geopolitical factors and environmental regulations shape the sourcing of zirconium precursors and the deployment of deposition infrastructure.

Market Forecast 2025–2030: Revenue Projections & Trends

The market for advanced zirconium vapor deposition technologies is poised for significant growth between 2025 and 2030, driven by escalating demand in sectors such as aerospace, nuclear energy, electronics, and biomedical devices. As applications requiring high-purity, corrosion-resistant, and thermally stable coatings proliferate, manufacturers are scaling up their vapor deposition capabilities and expanding product portfolios to capture emerging opportunities.

Recent announcements from leading industry participants indicate substantial investments in new physical vapor deposition (PVD) and chemical vapor deposition (CVD) lines tailored specifically for zirconium-based coatings. Praxair, Inc. has highlighted zirconium’s growing use in high-performance coatings for aerospace and energy, while ULVAC, Inc. is advancing modular deposition systems optimized for both research and high-throughput manufacturing. Equipment suppliers such as AzeoTech, Inc. are collaborating with materials companies to refine process control and film uniformity, crucial for next-generation zirconium nitride and zirconium oxide coatings.

From a revenue perspective, the market is projected to register a compound annual growth rate (CAGR) exceeding 8% through 2030, fueled by the expansion of end-user industries and the adoption of vapor deposition over traditional coating methods. Nuclear power is a notable driver, as zirconium’s exceptional neutron transparency and corrosion resistance make it indispensable for cladding and structural components. The sector’s robust outlook is reinforced by continued investments from global nuclear suppliers, including Westinghouse Electric Company and Framatome, who are increasingly sourcing advanced zirconium coatings to enhance fuel rod performance and longevity.

The electronics and semiconductor industries are also expected to boost demand, with companies like Tokyo Electron Limited developing deposition systems compatible with zirconium-based films for microelectronics and MEMS devices. Meanwhile, medical device manufacturers are incorporating zirconium vapor deposition for biocompatible, wear-resistant surfaces, responding to stricter regulatory standards and patient safety requirements.

- By 2027, the global market for advanced zirconium vapor deposition is expected to surpass $1.2 billion in annual revenue, with Asia-Pacific and North America leading adoption.

- Collaborations between equipment manufacturers and materials suppliers will accelerate innovation, focusing on process scalability and environmental compliance.

- Emerging applications in hydrogen energy, additive manufacturing, and battery technology are anticipated to drive incremental market expansion toward 2030.

In summary, the outlook for advanced zirconium vapor deposition technologies is robust, with strong multi-sector demand, technological innovation, and capacity expansions setting the stage for sustained double-digit growth over the next five years.

Sustainability and Regulatory Developments

The landscape of advanced zirconium vapor deposition technologies is evolving rapidly, with sustainability and regulatory compliance emerging as central themes through 2025 and the immediate years ahead. The growing adoption of zirconium-based coatings, particularly via physical vapor deposition (PVD) and chemical vapor deposition (CVD) processes, is being shaped by increasingly stringent environmental standards and industry-driven sustainability initiatives.

Regulatory attention is focusing on the reduction of hazardous emissions and the responsible handling of by-products commonly associated with traditional deposition methods. In response, manufacturers are advancing closed-loop gas management and filtration systems to minimize the environmental impact of precursor gases and effluents. For instance, leading zirconium material suppliers and coating system manufacturers such as Praxair and Linde have expanded their portfolios to include environmentally optimized process gases and recovery solutions for vapor deposition applications. These enhancements are designed to help coating facilities meet evolving local and international environmental regulations targeting air quality and occupational exposure.

Sustainability considerations are also influencing the choice of precursor materials, energy efficiency of deposition equipment, and the recyclability of coated products. Companies like Tosoh Corporation and ATI are investing in R&D to develop zirconium targets and precursors with reduced lifecycle environmental footprints. Simultaneously, equipment manufacturers are refining reactor designs to cut down on energy consumption and optimize coating uniformity, directly addressing both cost and ecological concerns.

From a regulatory perspective, the ongoing revision of standards such as the EU’s REACH regulation and the U.S. EPA’s National Emission Standards for Hazardous Air Pollutants (NESHAP) is prompting vapor deposition operators to adopt advanced abatement and monitoring technologies. This is particularly relevant for sectors like aerospace, medical devices, and electronics, where zirconium coatings play a critical role in performance and biocompatibility. Adherence to these updated frameworks is expected to become a primary factor in market access and customer procurement decisions through 2025 and beyond.

Looking forward, industry stakeholders are collaborating with standards bodies such as ASTM International to develop best practices and certification protocols for sustainable vapor deposition operations. These efforts aim to harmonize quality, environmental, and safety benchmarks worldwide, positioning advanced zirconium vapor deposition technologies as both high-performance and environmentally responsible solutions in the coming years.

Future Outlook: Emerging Opportunities and Challenges Ahead

The landscape for advanced zirconium vapor deposition technologies is rapidly evolving as industries demand higher-performance materials for corrosion resistance, thermal stability, and biocompatibility. As of 2025, the sector is experiencing notable momentum driven by the transition to next-generation semiconductors, nuclear energy upgrades, and biomedical device innovation. Major players are investing in refined chemical vapor deposition (CVD) and physical vapor deposition (PVD) processes to achieve ultra-thin, uniform zirconium coatings with precisely controlled stoichiometry and crystalline structure.

A key trend is the integration of atomic layer deposition (ALD) techniques for zirconium-based films. ALD enables conformal coatings even on complex 3D geometries, which is particularly advantageous in microelectronics and implantable medical devices. Recent announcements from established manufacturers indicate pilot-scale adoption of ALD for zirconium oxide and zirconium nitride coatings, targeting applications such as gate dielectrics and barrier layers in advanced semiconductor devices. Ferroglobe PLC and ATI Inc. have highlighted ongoing investments in research and development to improve precursor delivery systems and substrate compatibility for zirconium vapor deposition, aiming for commercial breakthroughs in the near future.

The nuclear sector remains a major user of zirconium coatings, especially for fuel cladding. With the push for safer, longer-lasting reactors, there is strong interest in advanced vapor deposition methods to enhance oxidation resistance and reduce hydrogen uptake in zirconium alloys. Industry leaders such as Westinghouse Electric Company are collaborating with research consortia to scale up PVD and CVD zirconium coatings for accident-tolerant fuel initiatives, with demonstration projects scheduled for late 2025 and beyond.

Despite the technical advances, several challenges remain. Uniform deposition on large or irregular substrates, precursor cost and availability, and environmental considerations surrounding byproduct handling are ongoing concerns. Additionally, the need for process standardization and in-line quality control is pushing equipment providers to innovate in real-time diagnostics and automation. As manufacturers like Linde plc and Praxair, Inc. expand their portfolio of high-purity zirconium precursors and gas delivery solutions, a more robust supply chain is expected to emerge.

Looking ahead, the next few years will likely see accelerated commercialization of advanced zirconium vapor deposition, particularly as end-user sectors implement stricter performance and sustainability criteria. Cross-sectoral collaboration and continued material science advances are poised to unlock new opportunities, while regulatory and economic factors will shape the pace and scale of technology adoption.

Sources & References

- ATI

- ULVAC

- Veeco Instruments Inc.

- Atos

- H.C. Starck Solutions

- Praxair

- Oxford Instruments

- Linde

- Honeywell International

- GE Aerospace

- Framatome

- Siemens Energy

- Smith & Nephew

- AMG Advanced Metallurgical Group N.V.

- Materion Corporation

- Sumitomo Electric Industries, Ltd.

- Sandvik

- Westinghouse Electric Company

- AzeoTech, Inc.

- ASTM International