Gallium Nitride Epitaxial Wafer Manufacturing in 2025: Powering the Future of High-Efficiency Electronics. Explore How Rapid Innovation and Market Expansion Are Shaping the Next Five Years.

- Executive Summary: Key Trends and 2025 Market Snapshot

- Market Size, Growth Rate, and 2029 Forecast (18% CAGR)

- Technology Overview: GaN Epitaxial Wafer Manufacturing Processes

- Major Players and Strategic Initiatives (e.g., nexgenpower.com, ams-osram.com, sumitomochemical.com)

- Application Landscape: Power Electronics, RF, and Optoelectronics

- Supply Chain Analysis and Raw Material Sourcing

- Regional Market Dynamics: Asia-Pacific, North America, Europe

- Innovation Drivers: Device Performance, Efficiency, and Miniaturization

- Challenges: Yield, Cost, and Scalability in GaN Epitaxy

- Future Outlook: Roadmap to 2030 and Emerging Opportunities

- Sources & References

Executive Summary: Key Trends and 2025 Market Snapshot

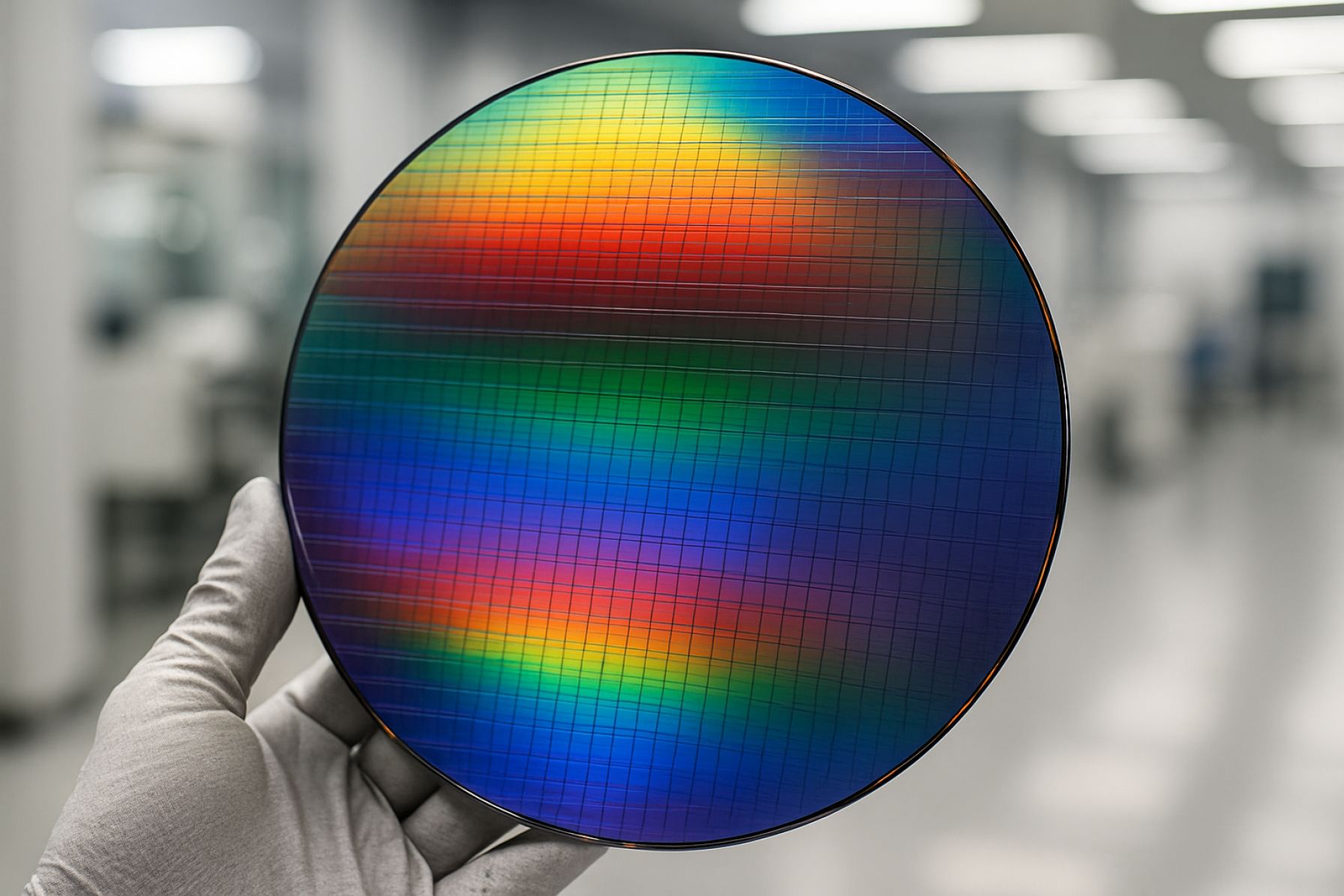

The gallium nitride (GaN) epitaxial wafer manufacturing sector is entering a pivotal phase in 2025, driven by surging demand for high-performance power electronics, radio frequency (RF) devices, and optoelectronic applications. GaN’s superior material properties—such as wide bandgap, high electron mobility, and thermal stability—are accelerating its adoption over traditional silicon and silicon carbide substrates, particularly in electric vehicles (EVs), 5G infrastructure, and advanced lighting.

Key industry players are scaling up production capacity and refining epitaxial growth techniques, notably metal-organic chemical vapor deposition (MOCVD), to meet stringent quality and volume requirements. ams OSRAM and Nichia Corporation remain global leaders in GaN wafer and device manufacturing, leveraging decades of expertise in LED and laser diode markets. Coherent Corp. (formerly II-VI Incorporated) and Sanan Optoelectronics are expanding their GaN epitaxy lines, targeting both power electronics and RF front-end modules for 5G and satellite communications.

In 2025, the market is witnessing a shift toward larger wafer diameters—transitioning from 4-inch to 6-inch and even 8-inch formats—to improve yield and reduce per-device costs. This transition is supported by investments from companies such as Epiworld International and Suquan Technology, which are ramping up 6-inch GaN-on-silicon and GaN-on-silicon carbide (SiC) epitaxial wafer production. The move to larger wafers is expected to accelerate in the next few years, with pilot lines for 8-inch GaN epitaxy under development.

Supply chain localization and vertical integration are also key trends, as manufacturers seek to secure raw material sources and control quality across the value chain. pSemi Corporation (a Murata company) and Innolight Technology are notable for their efforts in integrating epitaxial wafer production with device fabrication, aiming to shorten lead times and enhance performance consistency.

Looking ahead, the GaN epitaxial wafer market is poised for robust growth through 2025 and beyond, propelled by electrification trends, the proliferation of high-frequency communications, and the ongoing transition to solid-state lighting. Strategic investments in capacity, process innovation, and supply chain resilience will define the competitive landscape, with Asia-Pacific manufacturers expected to maintain a dominant position in global output.

Market Size, Growth Rate, and 2029 Forecast (18% CAGR)

The global market for gallium nitride (GaN) epitaxial wafer manufacturing is experiencing robust expansion, driven by surging demand in power electronics, radio frequency (RF) devices, and optoelectronics. As of 2025, the market is estimated to be valued in the low single-digit billions of US dollars, with leading industry participants reporting strong order books and capacity expansions. The compound annual growth rate (CAGR) for GaN epitaxial wafers is projected at approximately 18% through 2029, reflecting both technological advancements and the rapid adoption of GaN-based devices in automotive, consumer electronics, and industrial applications.

Key players in the GaN epitaxial wafer sector include IQE plc, a UK-based specialist in compound semiconductor epitaxy, and Kyocera Corporation, which has invested heavily in GaN substrate and wafer technology. Sanan Optoelectronics in China is another major supplier, with vertically integrated production from substrate to epitaxial wafer. Ferrotec Holdings Corporation and Sumitomo Electric Industries are also prominent, with the latter recognized for its proprietary hydride vapor phase epitaxy (HVPE) and metal-organic chemical vapor deposition (MOCVD) processes.

Recent years have seen significant investments in new MOCVD reactor installations and cleanroom expansions, particularly in Asia and Europe. For example, IQE plc has announced capacity increases to meet growing demand from RF and power device manufacturers. Meanwhile, Sanan Optoelectronics continues to scale up its GaN-on-silicon and GaN-on-silicon carbide (SiC) wafer production, targeting both domestic and international markets.

The market outlook through 2029 is underpinned by several factors: the electrification of vehicles, the rollout of 5G infrastructure, and the proliferation of fast-charging consumer devices. GaN’s superior electron mobility and breakdown voltage compared to silicon are accelerating its adoption in high-efficiency power conversion and RF front-end modules. As a result, wafer manufacturers are racing to improve yield, scale up 6-inch and 8-inch wafer production, and reduce defect densities.

By 2029, the GaN epitaxial wafer market is forecast to approach or exceed $5 billion, with Asia-Pacific remaining the dominant production hub. Strategic partnerships, long-term supply agreements, and continued process innovation are expected to characterize the competitive landscape, as established players and new entrants vie for market share in this high-growth sector.

Technology Overview: GaN Epitaxial Wafer Manufacturing Processes

Gallium nitride (GaN) epitaxial wafer manufacturing is a cornerstone technology for next-generation power electronics, RF devices, and optoelectronics. The process involves the deposition of high-purity GaN layers onto substrates, typically using metal-organic chemical vapor deposition (MOCVD) or hydride vapor phase epitaxy (HVPE). As of 2025, the industry is witnessing rapid advancements in both process control and substrate engineering, driven by the demand for higher device performance and cost efficiency.

MOCVD remains the dominant technique for GaN epitaxy, offering precise control over layer thickness, doping, and composition. Leading equipment suppliers such as AIXTRON SE and Veeco Instruments Inc. have introduced new MOCVD platforms with improved uniformity, throughput, and automation, enabling mass production of 6-inch and 8-inch GaN-on-silicon wafers. These larger wafer formats are critical for scaling up device manufacturing and reducing per-unit costs.

Substrate selection is a key factor in GaN epitaxial wafer quality. While sapphire and silicon carbide (SiC) have been traditional choices, silicon substrates are gaining traction due to their lower cost and compatibility with existing semiconductor fabs. Companies like Nitride Semiconductors Co., Ltd. and onsemi are actively developing GaN-on-silicon technologies, targeting high-volume applications in power conversion and RF. Meanwhile, IQE plc and Sumitomo Electric Industries, Ltd. continue to advance GaN-on-SiC epitaxy for high-frequency and high-power devices, leveraging SiC’s superior thermal conductivity.

Defect reduction and uniformity improvements are ongoing challenges. Advanced in-situ monitoring and real-time process analytics are being integrated into epitaxial reactors, allowing for tighter control of growth parameters and early detection of anomalies. This is particularly important for achieving the low dislocation densities required for high-reliability power and RF devices.

Looking ahead, the next few years are expected to see further adoption of 8-inch GaN epitaxial wafers, as well as the emergence of novel substrates and buffer layer technologies. Collaborative efforts between wafer manufacturers and device makers, such as those by Wolfspeed, Inc. and ROHM Co., Ltd., are accelerating the commercialization of advanced GaN materials. These developments are poised to support the expanding markets for electric vehicles, 5G infrastructure, and energy-efficient power systems through 2025 and beyond.

Major Players and Strategic Initiatives (e.g., nexgenpower.com, ams-osram.com, sumitomochemical.com)

The global landscape of gallium nitride (GaN) epitaxial wafer manufacturing in 2025 is characterized by rapid capacity expansion, strategic partnerships, and technological innovation among leading industry players. As demand for GaN-based devices in power electronics, RF, and optoelectronics accelerates, established manufacturers and new entrants are intensifying efforts to secure market share and technological leadership.

Among the most prominent companies, Sumitomo Chemical continues to be a key supplier of GaN epitaxial wafers, leveraging decades of expertise in compound semiconductor materials. The company has invested in scaling up production and refining metal-organic chemical vapor deposition (MOCVD) processes to deliver high-quality, large-diameter wafers suitable for next-generation power and RF applications. Sumitomo Chemical’s strategic focus includes collaboration with device manufacturers to optimize wafer specifications for high-yield, high-performance device fabrication.

Another major player, ams-OSRAM, is recognized for its vertically integrated approach, spanning from GaN epitaxy to device manufacturing, particularly in the field of optoelectronics and advanced lighting. In 2024 and 2025, ams-OSRAM has announced further investments in expanding its GaN wafer production capacity, with a focus on 6-inch and 8-inch wafers to meet the growing needs of automotive, industrial, and consumer electronics sectors. The company’s strategic initiatives include partnerships with equipment suppliers and research institutions to accelerate the adoption of GaN-on-silicon and GaN-on-silicon carbide (SiC) technologies.

Emerging companies such as NexGen Power Systems are also making significant strides. NexGen Power Systems specializes in GaN-on-GaN epitaxial wafer technology, which offers superior thermal and electrical performance compared to traditional GaN-on-silicon substrates. The company’s recent announcements highlight the commissioning of new epitaxy reactors and the establishment of pilot production lines aimed at supporting the commercialization of high-efficiency power conversion devices.

Other notable manufacturers include IQE, a global supplier of advanced semiconductor materials, which has expanded its GaN epitaxy capabilities to serve both RF and power device markets. IQE’s strategic initiatives involve collaborations with foundries and device makers to ensure supply chain resilience and accelerate time-to-market for GaN-based products.

Looking ahead, the competitive landscape is expected to intensify as companies pursue further capacity expansions, vertical integration, and technology partnerships. The focus on larger wafer diameters, improved material quality, and cost reduction will remain central to strategic initiatives, positioning these major players at the forefront of the GaN epitaxial wafer industry through 2025 and beyond.

Application Landscape: Power Electronics, RF, and Optoelectronics

Gallium nitride (GaN) epitaxial wafers are at the forefront of innovation in power electronics, radio frequency (RF) devices, and optoelectronics, with 2025 marking a period of accelerated adoption and technological refinement. The unique material properties of GaN—such as wide bandgap, high electron mobility, and superior thermal conductivity—are driving its integration into next-generation devices across these sectors.

In power electronics, GaN epitaxial wafers are enabling the production of high-efficiency transistors and diodes for applications ranging from electric vehicles (EVs) to renewable energy inverters and fast-charging infrastructure. Leading manufacturers like Infineon Technologies AG and STMicroelectronics have expanded their GaN device portfolios, leveraging in-house and partner-sourced epitaxial wafer supply to meet surging demand for compact, high-performance power modules. The automotive sector, in particular, is expected to see a significant uptick in GaN adoption for onboard chargers and DC-DC converters, as OEMs seek to improve energy efficiency and reduce system size.

In the RF domain, GaN epitaxial wafers are critical for fabricating high-power, high-frequency amplifiers used in 5G base stations, satellite communications, and radar systems. Companies such as Mitsubishi Electric Corporation and NXP Semiconductors are actively scaling up their GaN RF device production, citing the material’s ability to deliver higher output power and efficiency compared to traditional silicon or even silicon carbide (SiC) solutions. The ongoing global rollout of 5G and the expansion of defense and aerospace applications are expected to sustain robust demand for GaN RF components through 2025 and beyond.

In optoelectronics, GaN epitaxial wafers underpin the manufacture of high-brightness LEDs, laser diodes, and emerging micro-LED displays. OSRAM and Nichia Corporation remain at the forefront of GaN-based optoelectronic device innovation, with ongoing investments in epitaxial wafer quality and large-diameter substrate development. The micro-LED display segment, in particular, is poised for growth as consumer electronics and automotive display manufacturers seek higher brightness, efficiency, and longevity.

Looking ahead, the application landscape for GaN epitaxial wafers is set to broaden further, with continued advances in wafer uniformity, defect reduction, and scalable manufacturing processes. Strategic collaborations between wafer suppliers and device manufacturers are expected to accelerate, ensuring a stable supply chain and fostering the next wave of high-performance electronic and photonic systems.

Supply Chain Analysis and Raw Material Sourcing

The supply chain for gallium nitride (GaN) epitaxial wafer manufacturing in 2025 is characterized by increasing vertical integration, strategic partnerships, and a focus on securing critical raw materials. GaN wafers are foundational for high-performance power electronics and RF devices, and their production relies on a complex network of suppliers for both substrate materials and precursor chemicals.

The primary raw materials for GaN epitaxial wafers are high-purity gallium, ammonia, and substrates such as silicon carbide (SiC), sapphire, or silicon. The majority of gallium is produced as a byproduct of aluminum and zinc refining, with significant output from countries like China, Germany, and Kazakhstan. In recent years, supply chain vulnerabilities have prompted leading manufacturers to diversify sourcing and invest in recycling initiatives. For example, Nichia Corporation, a major GaN wafer and LED producer, has emphasized the importance of stable gallium supply and has developed in-house purification processes to mitigate external risks.

On the substrate side, companies such as Coherent Corp. (formerly II-VI Incorporated) and SICC Co., Ltd. are key suppliers of SiC and sapphire substrates, respectively. These substrates are critical for high-quality GaN epitaxy, and their availability directly impacts wafer output. The ongoing expansion of SiC substrate production capacity, particularly in Asia and the United States, is expected to alleviate some supply constraints by 2025, though demand continues to outpace supply in certain segments.

Epitaxial growth of GaN layers is typically performed using metal-organic chemical vapor deposition (MOCVD) reactors. Leading equipment suppliers such as AIXTRON SE and Veeco Instruments Inc. have reported strong order books through 2025, reflecting robust investment in new capacity by wafer manufacturers. These companies also collaborate closely with chemical suppliers to ensure a consistent supply of high-purity precursors like trimethylgallium and ammonia.

Looking ahead, the GaN wafer supply chain is expected to become more resilient as manufacturers pursue long-term contracts, backward integration, and recycling of gallium from end-of-life devices. However, geopolitical factors and the concentration of gallium refining in a few countries remain potential risks. Industry groups such as Semiconductor Industry Association are advocating for policies to strengthen domestic supply chains and encourage investment in critical material processing.

In summary, while the GaN epitaxial wafer supply chain in 2025 is more robust than in previous years, ongoing efforts to secure raw materials, expand substrate production, and localize key processes will be essential to meet the rapidly growing demand for GaN-based devices in the coming years.

Regional Market Dynamics: Asia-Pacific, North America, Europe

The global landscape for gallium nitride (GaN) epitaxial wafer manufacturing is characterized by distinct regional dynamics, with Asia-Pacific, North America, and Europe each playing pivotal roles in the sector’s evolution through 2025 and beyond.

Asia-Pacific remains the dominant force in GaN epitaxial wafer production, driven by robust investments, established supply chains, and the presence of leading manufacturers. Countries such as China, Japan, South Korea, and Taiwan are at the forefront. In China, state-backed initiatives and aggressive capacity expansions by companies like San’an Optoelectronics and Enkris Semiconductor are accelerating domestic GaN wafer output, targeting both power electronics and RF applications. Japan’s Sumitomo Chemical and Mitsubishi Electric continue to leverage decades of compound semiconductor expertise, focusing on high-quality substrates and advanced epitaxial processes. South Korea’s Samsung Electronics and LG Electronics are also investing in GaN technologies, particularly for next-generation consumer electronics and automotive applications.

North America is distinguished by its focus on innovation and high-performance GaN solutions, with a strong ecosystem of research institutions and commercial players. The United States is home to key manufacturers such as Wolfspeed (formerly Cree), which operates one of the world’s largest GaN and SiC wafer fabs, and Qorvo, a leader in RF GaN devices. These companies are expanding capacity and advancing 6-inch and 8-inch GaN wafer technologies to meet surging demand in 5G, defense, and electric vehicle (EV) markets. Strategic partnerships and government-backed R&D programs are expected to further bolster North American competitiveness in the coming years.

Europe is emerging as a significant player, particularly in the context of supply chain resilience and sustainability. The European Union’s focus on semiconductor sovereignty has spurred investments in GaN manufacturing infrastructure. Companies such as Infineon Technologies (Germany) and STMicroelectronics (France/Italy) are scaling up GaN epitaxial wafer production, targeting automotive, industrial, and renewable energy sectors. Collaborative initiatives, including public-private partnerships and cross-border research projects, are expected to accelerate the region’s technological capabilities and market share through 2025.

Looking ahead, the Asia-Pacific region is projected to maintain its leadership in volume production, while North America and Europe are likely to gain ground in high-value, specialized GaN wafer applications. Regional policy support, supply chain strategies, and continued innovation will shape the competitive landscape of GaN epitaxial wafer manufacturing in the next few years.

Innovation Drivers: Device Performance, Efficiency, and Miniaturization

The manufacturing of gallium nitride (GaN) epitaxial wafers is being rapidly transformed by innovation drivers centered on device performance, efficiency, and miniaturization. As of 2025, these factors are shaping both the technological roadmap and the competitive landscape for GaN wafer suppliers and device manufacturers.

A primary innovation driver is the relentless demand for higher device performance, particularly in power electronics and radio frequency (RF) applications. GaN’s superior electron mobility and breakdown voltage compared to silicon enable devices with higher switching frequencies, lower losses, and greater power density. Leading manufacturers such as Nichia Corporation and Kyocera Corporation are investing in advanced metal-organic chemical vapor deposition (MOCVD) and hydride vapor phase epitaxy (HVPE) processes to produce high-purity, low-defect GaN layers, which are critical for next-generation high-electron-mobility transistors (HEMTs) and power ICs.

Efficiency improvements are another key driver, especially as industries seek to reduce energy consumption and thermal management challenges. GaN-based devices, enabled by high-quality epitaxial wafers, are increasingly replacing silicon in fast-charging adapters, data center power supplies, and electric vehicle (EV) inverters. Companies like Ferrotec Holdings Corporation and Siltronic AG are scaling up production of larger-diameter GaN-on-silicon and GaN-on-silicon carbide (SiC) wafers, which allow for higher device yields and improved cost efficiency.

Miniaturization is also accelerating innovation in GaN epitaxial wafer manufacturing. The ability to fabricate smaller, more integrated devices is crucial for applications in 5G communications, automotive radar, and consumer electronics. Samsung Electronics and Soraa Inc. are among the companies developing advanced wafer thinning, patterning, and substrate engineering techniques to support the integration of GaN devices into compact modules and system-in-package (SiP) solutions.

Looking ahead to the next few years, the industry is expected to see further advances in defect reduction, uniformity control, and scalable substrate technologies. Collaborative efforts between wafer suppliers, device manufacturers, and equipment vendors are likely to accelerate, with a focus on 8-inch (200 mm) GaN wafer platforms and novel heteroepitaxial approaches. These innovations are poised to unlock new levels of device performance, energy efficiency, and miniaturization, reinforcing GaN’s role as a foundational material for the electronics of the future.

Challenges: Yield, Cost, and Scalability in GaN Epitaxy

Gallium nitride (GaN) epitaxial wafer manufacturing faces persistent challenges in yield, cost, and scalability as the industry enters 2025. The drive for higher performance in power electronics, RF devices, and optoelectronics has intensified the need for high-quality, large-diameter GaN wafers. However, several technical and economic barriers remain.

A primary challenge is the high defect density inherent in GaN epitaxy, especially when grown on foreign substrates such as sapphire or silicon. Threading dislocations and other crystalline defects can significantly impact device performance and yield. While advances in metal-organic chemical vapor deposition (MOCVD) and hydride vapor phase epitaxy (HVPE) have improved material quality, achieving consistently low defect densities at scale remains difficult. Leading manufacturers such as Kyocera and Sumitomo Chemical have invested in proprietary buffer layer technologies and substrate engineering to mitigate these issues, but the complexity of the processes contributes to high production costs.

Cost is further exacerbated by the limited availability and high price of native GaN substrates. While most commercial GaN wafers are still produced on sapphire or silicon, native GaN substrates offer superior performance but are expensive and difficult to produce in large diameters. Companies like Ammono (now part of JX Nippon Mining & Metals) have pioneered ammonothermal growth methods for bulk GaN, but scaling these processes to meet industry demand remains a significant hurdle.

Scalability is another pressing concern. The transition from 4-inch to 6-inch and even 8-inch GaN-on-silicon wafers is underway, driven by the need for higher throughput and compatibility with existing semiconductor fabs. However, larger wafers introduce new challenges in uniformity, bowing, and cracking during growth and post-processing. Ferrotec and Coherent Corp. (formerly II-VI Incorporated) are among the suppliers working to address these issues through advanced reactor designs and in-situ monitoring technologies.

Looking ahead, the industry is expected to see incremental improvements in yield and cost efficiency through process automation, better precursor utilization, and the adoption of digital twin technologies for epitaxy. However, the fundamental materials challenges—especially for native GaN substrates—are likely to persist into the next few years. Collaboration between wafer manufacturers, equipment suppliers, and end-users will be critical to overcoming these barriers and enabling the widespread adoption of GaN-based devices in power, RF, and photonics markets.

Future Outlook: Roadmap to 2030 and Emerging Opportunities

The future outlook for gallium nitride (GaN) epitaxial wafer manufacturing through 2025 and toward 2030 is marked by rapid technological advancements, capacity expansions, and the emergence of new application domains. As the global demand for high-efficiency power electronics and radio frequency (RF) devices accelerates, manufacturers are scaling up both substrate sizes and production volumes to meet the needs of automotive, consumer electronics, 5G infrastructure, and renewable energy sectors.

A key trend is the transition from 4-inch to 6-inch and even 8-inch GaN-on-silicon (GaN-on-Si) and GaN-on-silicon carbide (GaN-on-SiC) wafers. This shift is driven by the need for higher throughput and lower cost per device, as well as compatibility with existing silicon foundry processes. Leading manufacturers such as IQE plc, Ferrotec Holdings Corporation, and Kyocera Corporation are investing in new MOCVD (metal-organic chemical vapor deposition) reactor lines and automation to support this scaling. For example, IQE plc has announced capacity expansions in its UK and US facilities, targeting both power and RF markets.

Another significant development is the increasing vertical integration among wafer suppliers and device manufacturers. Companies such as Nichia Corporation and ROHM Co., Ltd. are not only producing GaN epitaxial wafers but also fabricating discrete and integrated devices, ensuring tighter control over quality and supply chain resilience. This trend is expected to intensify as end-users demand higher reliability and performance for automotive and industrial applications.

Emerging opportunities are also arising from the push toward ultra-wide bandgap (UWBG) materials and novel device architectures. Research and pilot production of aluminum gallium nitride (AlGaN) and other alloyed structures are underway, with companies like Nitride Semiconductors Co., Ltd. exploring deep-UV and high-frequency device markets. Additionally, the adoption of GaN-on-diamond substrates, being developed by select innovators, promises further improvements in thermal management and device efficiency.

Looking ahead to 2030, the GaN epitaxial wafer sector is poised for robust growth, underpinned by electrification trends, the proliferation of fast-charging infrastructure, and the expansion of 5G/6G networks. Strategic partnerships, government-backed R&D initiatives, and continued investment in manufacturing scale and automation will be critical to maintaining momentum and capturing emerging opportunities in this dynamic field.

Sources & References

- ams OSRAM

- Nichia Corporation

- pSemi Corporation

- IQE plc

- Ferrotec Holdings Corporation

- Sumitomo Electric Industries

- AIXTRON SE

- Veeco Instruments Inc.

- Wolfspeed, Inc.

- ROHM Co., Ltd.

- Sumitomo Chemical

- NexGen Power Systems

- Infineon Technologies AG

- STMicroelectronics

- Mitsubishi Electric Corporation

- NXP Semiconductors

- OSRAM

- Nichia Corporation

- Sumitomo Chemical

- LG Electronics

- Siltronic AG

- Soraa Inc.

- JX Nippon Mining & Metals

- Nitride Semiconductors Co., Ltd.