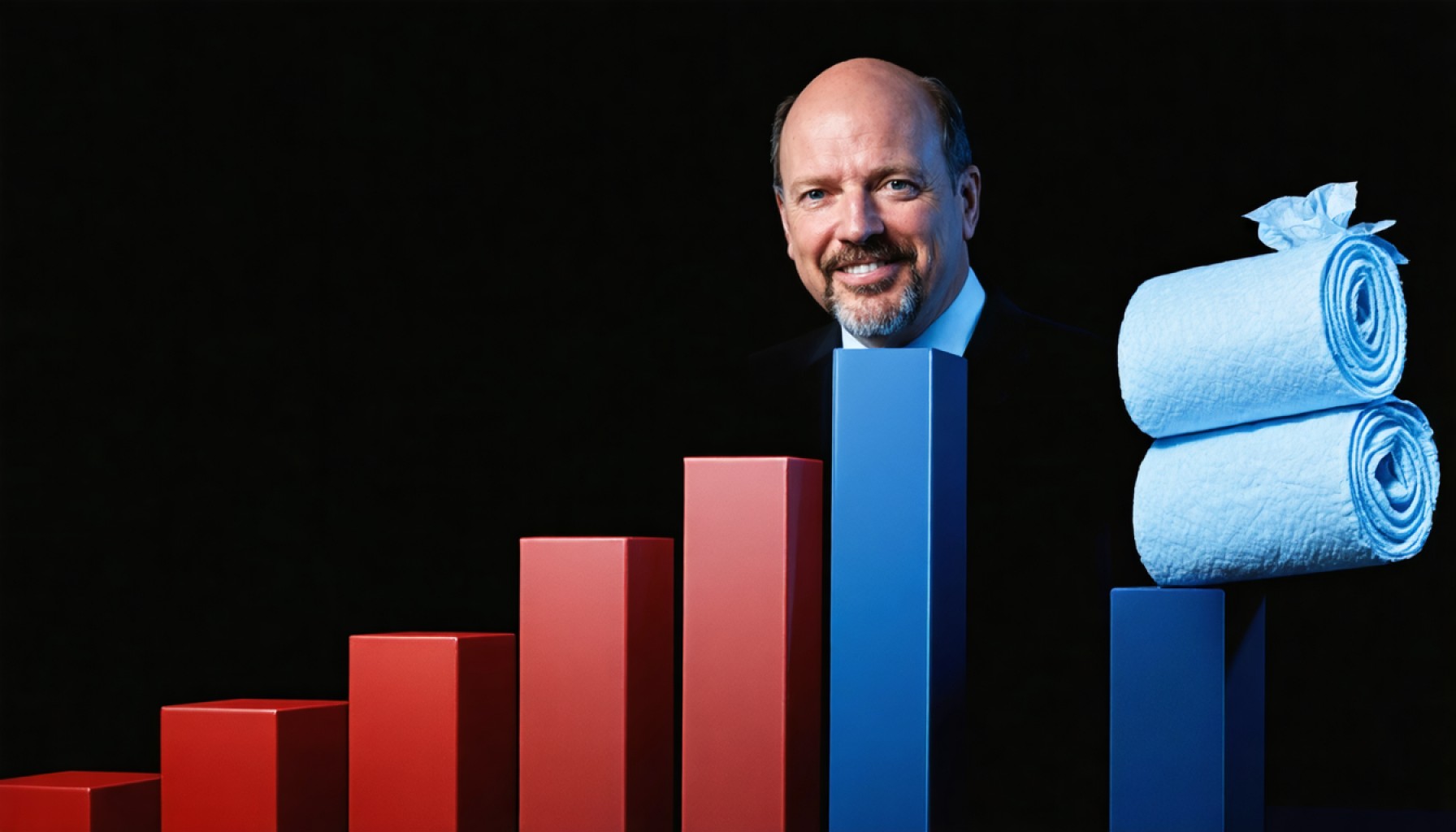

- Jim Cramer spotlighted Kimberly-Clark’s (NYSE:KMB) transformation from a defensive to an offensive investment option amid rising diaper sales.

- Kimberly-Clark’s stock value increased by 11.68%, validating Cramer’s predictions.

- The Federal Reserve’s influence, particularly through the Federal Open Market Committee, impacts market sentiment with its decisions on interest rates and inflation.

- Cramer emphasized the interconnectedness of economic factors, highlighting housing market slowdowns and potential retail implications.

- Cramer’s alert about looming tariffs, especially a 25% tax on imported vehicles from major automotive nations, added urgency to market considerations.

- He suggested a focus on strategic investments influenced more by Washington’s political decisions than individual company earnings.

- The potential of AI stocks was noted as they offer opportunities for higher returns compared to traditional investments.

- Cramer’s overarching message underscores the power of being informed and prepared in navigating market opportunities.

In a world dominated by rapid market shifts and unpredictable economic landscapes, clear-sighted guidance becomes a beacon for investors. Twelve months ago, Jim Cramer, the spirited host of “Mad Money,” shone a spotlight on Kimberly-Clark Corporation (NYSE:KMB), urging investors to keep a keen eye on its transition from a sturdy defensive player to a potential offensive powerhouse. As diaper sales soared amidst the mundane chaos of everyday life, Cramer hinted at KMB’s readiness to seize the moment.

Fast forward to the present, Kimberly-Clark has seen its stock value increase by 11.68%, underscoring Cramer’s insight. This growth comes amidst a backdrop of economic apprehension where the Federal Reserve wields significant influence, casting long shadows over market sentiments with its looming meetings and pronouncements about interest rates.

Cramer didn’t just stop at Kimberly-Clark. He alerted viewers to a web of economic factors poised to reshape the market. With the Federal Open Market Committee meeting on the horizon and Jerome Powell ready to address inflation—a specter still haunting certain economic sectors—investors were advised to brace themselves for impactful declarations. Housing data, too, played a critical role, as Cramer articulated the delicate domino effect a housing market slowdown could precipitate, ultimately leading to retail turbulence.

Yet amidst these cautious whispers, a louder concern emerged. The specter of fresh tariffs, particularly a daunting 25% on imported vehicles from automotive giants such as Germany, Japan, and South Korea, loomed large. With markets often swayed by presidential decisions, Cramer’s speculations on potential tariff announcements cast an urgent tone over the week’s trading narrative.

Despite these swirling uncertainties, Cramer steadfastly believed that the week’s fate lay more in Washington’s hands than in individual company earnings. His guidance suggested a need for preparedness, blending vigilance with strategic investment maneuvers.

The tale doesn’t end with the unfolding of events past; it continues in the choices we make for future investments. For those casting wider nets, the allure of artificial intelligence stocks beckons with promises of higher and swifter returns. While Kimberly-Clark proved resilient, the dynamic world of AI stocks tantalizes with its potential to exponentially outperform traditional picks.

So, as market participants dissect Cramer’s year-old advisories, a broader lesson remains: in investing, as in life, being informed means being empowered. The dance between caution and opportunity continues, urging investors to traverse it with both awareness and zest.

Why Investors Should Pay Attention to Jim Cramer’s Market Predictions

In today’s volatile economic landscape, having a reliable source of investment advice can make a significant difference for investors. Jim Cramer, the vibrant host of “Mad Money,” has demonstrated an uncanny ability to anticipate market trends, as evidenced by his foresight regarding Kimberly-Clark Corporation (NYSE:KMB) a year ago. Let’s delve deeper into the implications of Cramer’s advisories and explore new opportunities for investors.

Insights into Kimberly-Clark’s Performance

Kimberly-Clark’s transition from a defensive to an offensive market stance, as observed by Cramer, resulted in an impressive stock value increase of 11.68%. This growth was likely fueled by increased diaper sales and the company’s strategic market positioning, positioning it as a robust choice for cautious investors amidst economic uncertainty.

Real-World Use Cases

For investors, Kimberly-Clark serves as a sterling example of a company bolstering its market presence through diversified product lines, such as personal care and tissue products, gaining consumer trust and driving consistent revenue streams. Here are some steps on how investors can leverage such insights:

1. Diversify Holdings: Just as Kimberly-Clark diversified its product line, investors should diversify portfolios to hedge against market volatility.

2. Market Research: Stay informed about consumer trends and emerging needs which can drive the demand for specific products or services.

3. Long-term Perspective: Focus on companies with strong fundamentals that can withstand market fluctuations.

Economic Concerns and Market Predictions

Cramer rightly highlighted the impact of the Federal Reserve, particularly regarding interest rates and their ripple effects across sectors such as housing and retail. Additionally, the looming threat of tariffs on imported vehicles remains a critical factor.

Market Forecasts & Industry Trends

1. Federal Reserve Decisions: Keeping abreast of FOMC meetings and interest rate trajectories can aid investors in adjusting strategies in real-time.

2. Tariff Implications: Industries reliant on imports, like automotive, should be carefully monitored. Any tariff announcements could influence stock prices sharply.

The Allure of AI Stocks

Despite Kimberly-Clark’s resilient performance, the allure of artificial intelligence (AI) stocks cannot be overstated. As companies continue to integrate AI, the sector is teeming with potential for high yields.

Features & Market Opportunities

– Growth Potential: AI technologies are rapidly evolving, offering unprecedented opportunities in sectors like healthcare, finance, and autonomous vehicles.

– Investment Strategy: Consider a mix of established tech giants and emerging AI startups to diversify exposure in your portfolio.

Pros & Cons Overview

Pros:

– Defensive Stocks: Brands like Kimberly-Clark provide stability and consistent dividends.

– AI Stocks: Offer high growth potential and are at the forefront of technological innovation.

Cons:

– Market Volatility: Economic shifts and policy changes can abruptly affect stock prices.

– Tech Uncertainties: AI stocks can be speculative and pricing models may fluctuate.

Actionable Recommendations

1. Stay Informed: Regularly follow expert advice and market analyses from reliable sources.

2. Balance Portfolios: Blend defensive stocks with high-growth prospects like AI for a well-rounded investment strategy.

3. Remain Agile: Be prepared to adjust your investment approach based on economic developments and geopolitical tensions.

For more economic insights and investment guidance, you might visit credible sources like CNBC.

Investing is a long-term endeavor where understanding market dynamics is key. By blending awareness with strategic decisions, investors can navigate the dance between caution and opportunity effectively, much like the insights Jim Cramer offers to his audience.