Quantum Integrated Waveguide Photonics Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities. Explore Market Size, Leading Players, and Strategic Forecasts Through 2030.

- Executive Summary & Market Overview

- Key Technology Trends in Quantum Integrated Waveguide Photonics

- Competitive Landscape and Leading Market Players

- Market Growth Forecasts and Revenue Projections (2025–2030)

- Regional Analysis: North America, Europe, Asia-Pacific & Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

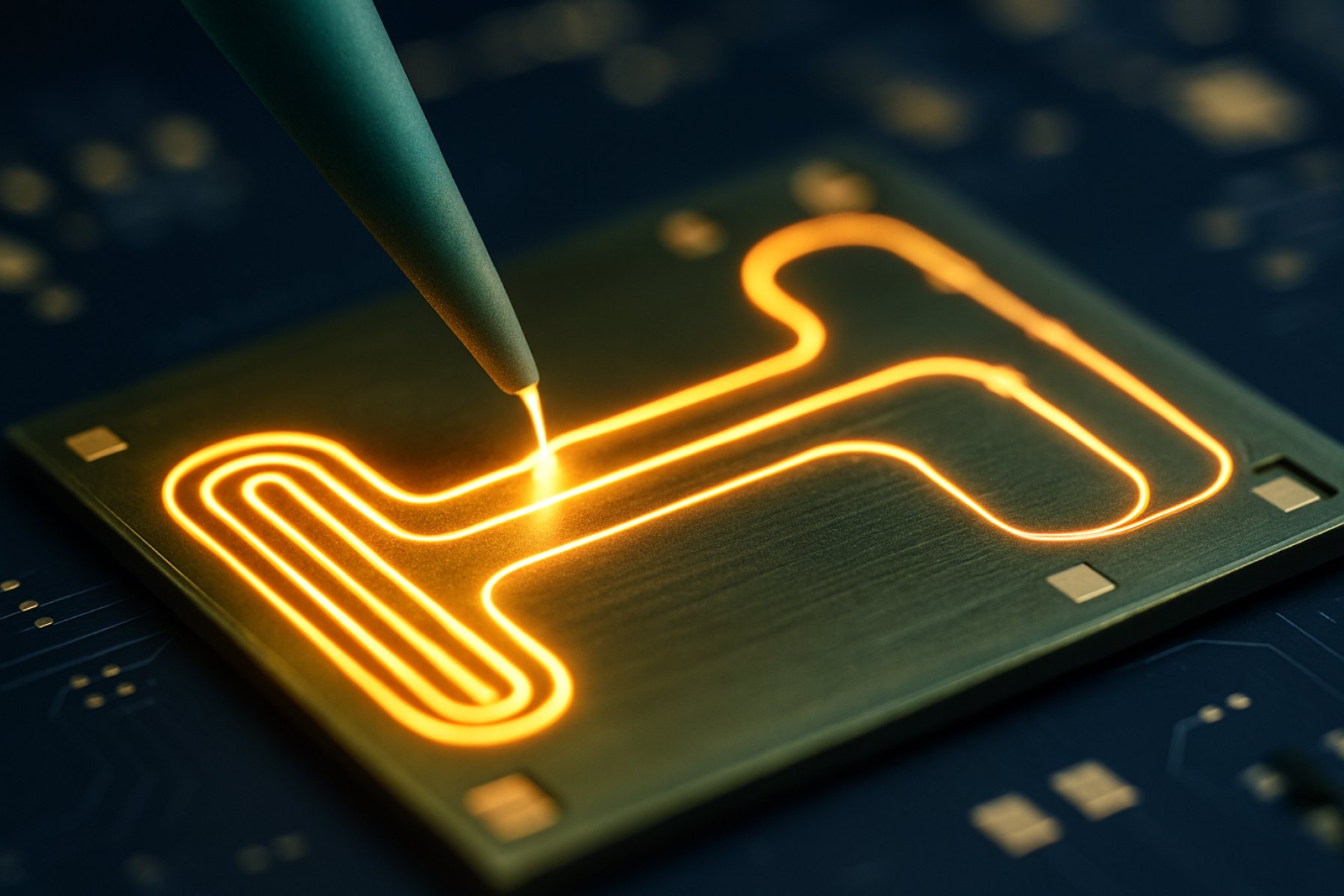

Quantum Integrated Waveguide Photonics (QIWP) represents a transformative frontier in quantum technology, leveraging the integration of photonic waveguides on chip-scale platforms to manipulate and transmit quantum information. As of 2025, the QIWP market is experiencing accelerated growth, driven by advancements in quantum computing, secure communications, and quantum sensing. The integration of photonic components—such as sources, modulators, and detectors—onto a single substrate enables scalable, low-loss, and high-fidelity quantum circuits, addressing key challenges in the commercialization of quantum technologies.

The global QIWP market is projected to reach a valuation of over $1.2 billion by 2025, with a compound annual growth rate (CAGR) exceeding 30% from 2022 to 2025, according to MarketsandMarkets. This growth is underpinned by significant investments from both public and private sectors, with governments in the US, EU, and China prioritizing quantum photonics in their national quantum initiatives. The European Union’s Quantum Flagship program and the US National Quantum Initiative Act have catalyzed research and commercialization efforts, fostering a robust ecosystem of startups and established players.

Key industry participants include Paul Scherrer Institute, Infinera Corporation, and Xanadu, each contributing to breakthroughs in integrated photonic chips and quantum light sources. Strategic collaborations between academia and industry are accelerating the translation of laboratory innovations into market-ready products, particularly in quantum key distribution (QKD) and photonic quantum computing.

The market landscape is characterized by rapid technological evolution, with silicon photonics, lithium niobate, and indium phosphide emerging as leading material platforms for integrated quantum photonics. The convergence of mature semiconductor fabrication techniques with quantum photonic design is reducing costs and improving device performance, making QIWP increasingly attractive for commercial deployment.

Looking ahead, the QIWP sector is poised for continued expansion, fueled by the growing demand for secure communications, high-performance computing, and advanced sensing solutions. However, challenges remain in large-scale integration, standardization, and supply chain development. Addressing these hurdles will be critical for sustaining momentum and realizing the full potential of quantum integrated waveguide photonics in the coming years.

Key Technology Trends in Quantum Integrated Waveguide Photonics

Quantum Integrated Waveguide Photonics (QIWP) is rapidly emerging as a foundational technology for scalable quantum information processing, communication, and sensing. In 2025, several key technology trends are shaping the evolution and commercialization of QIWP, driven by advances in materials science, device integration, and quantum system architectures.

- Heterogeneous Integration of Materials: The integration of diverse materials—such as silicon, silicon nitride, lithium niobate, and III-V semiconductors—on a single chip is enabling the co-location of sources, modulators, and detectors. This trend is exemplified by the adoption of hybrid platforms that combine the low-loss propagation of silicon nitride with the efficient electro-optic properties of lithium niobate, as reported by imec and LIGENTEC.

- On-Chip Quantum Light Sources: The development of integrated, deterministic single-photon sources—such as quantum dots and color centers—has accelerated, with companies like ams OSRAM and Xanadu demonstrating scalable, chip-based photon generation. These sources are critical for quantum key distribution (QKD) and photonic quantum computing.

- Programmable Photonic Circuits: Advances in reconfigurable photonic circuits, leveraging thermo-optic and electro-optic phase shifters, are enabling dynamic control of quantum states on-chip. Startups such as Lightmatter and PsiQuantum are at the forefront, developing large-scale programmable photonic processors for quantum applications.

- Integrated Quantum Detectors: Superconducting nanowire single-photon detectors (SNSPDs) and avalanche photodiodes are being monolithically integrated with waveguide platforms, improving detection efficiency and reducing system complexity. Single Quantum and ID Quantique are leading providers of these integrated detection solutions.

- Quantum Photonic Packaging and Interconnects: Robust packaging and low-loss fiber-to-chip coupling remain critical challenges. In 2025, new approaches—such as photonic wire bonding and 3D integration—are being adopted to enhance scalability and manufacturability, as highlighted by EUROPRACTICE.

These trends collectively point toward a future where quantum photonic circuits are mass-manufactured, highly integrated, and ready for deployment in quantum networks and processors, accelerating the commercialization of quantum technologies.

Competitive Landscape and Leading Market Players

The competitive landscape of the quantum integrated waveguide photonics market in 2025 is characterized by a dynamic mix of established photonics companies, quantum technology startups, and collaborative research initiatives. The sector is witnessing rapid innovation, driven by the demand for scalable, low-loss, and highly integrated photonic circuits for quantum computing, secure communications, and advanced sensing applications.

Key market players are leveraging proprietary fabrication techniques, material science advancements, and strategic partnerships to gain a competitive edge. imec and CEA-Leti are at the forefront of silicon photonics research, offering foundry services and collaborating with quantum startups to accelerate the commercialization of integrated quantum photonic chips. Xanadu and PsiQuantum are notable for their focus on photonic quantum computing, with both companies developing large-scale, fault-tolerant quantum processors based on integrated waveguide architectures.

European players such as Quantum Delta NL and QuTech are fostering innovation through ecosystem-building and public-private partnerships, supporting startups and academic spin-offs in the integrated photonics space. In the Asia-Pacific region, NTT and NICT are investing heavily in quantum photonic R&D, focusing on secure quantum communication networks and integrated photonic devices.

The market is also seeing increased activity from established semiconductor and optics companies. Intel and IBM are exploring hybrid integration of quantum photonics with conventional CMOS processes, aiming to bridge the gap between classical and quantum information processing. Thorlabs and Lumentum are expanding their product portfolios to include components and modules tailored for quantum photonic applications.

- Strategic alliances and consortia, such as the European Quantum Communication Infrastructure (EuroQCI), are accelerating technology transfer and standardization efforts.

- Startups like Lightmatter and ORCA Computing are attracting significant venture capital, focusing on novel waveguide designs and quantum photonic interconnects.

- Patent activity and intellectual property strategies are intensifying, with leading players seeking to secure key positions in integrated quantum photonics platforms.

Overall, the competitive landscape in 2025 is marked by rapid technological convergence, cross-sector collaboration, and a race to achieve scalable, manufacturable quantum integrated waveguide photonic solutions.

Market Growth Forecasts and Revenue Projections (2025–2030)

The market for Quantum Integrated Waveguide Photonics is poised for significant expansion between 2025 and 2030, driven by accelerating investments in quantum computing, secure communications, and advanced sensing technologies. According to projections from IDTechEx, the global quantum technologies market, which includes integrated photonics platforms, is expected to surpass $5 billion by 2025, with integrated photonics representing a rapidly growing segment due to its scalability and compatibility with existing semiconductor manufacturing processes.

Specifically, the quantum integrated waveguide photonics segment is forecasted to achieve a compound annual growth rate (CAGR) exceeding 30% from 2025 to 2030. This growth is underpinned by increasing adoption in quantum key distribution (QKD) networks, quantum computing hardware, and quantum-enhanced sensors. MarketsandMarkets estimates that the photonic quantum computing market alone will reach approximately $1.3 billion by 2030, with waveguide-based solutions accounting for a substantial share due to their miniaturization and integration capabilities.

Revenue projections are further bolstered by strategic partnerships and funding rounds among leading industry players and research institutions. For instance, Paul Scherrer Institute and Imperial College London have reported breakthroughs in low-loss waveguide fabrication, which are expected to accelerate commercialization efforts. Additionally, companies such as PsiQuantum and Xanadu are attracting significant venture capital, with PsiQuantum alone raising over $700 million to develop scalable photonic quantum computers.

Regionally, North America and Europe are anticipated to lead market growth, supported by robust government funding and a strong ecosystem of quantum startups and established photonics manufacturers. Asia-Pacific is also emerging as a key market, with countries like China and Japan investing heavily in quantum infrastructure and photonic chip fabrication capabilities (Nature).

In summary, the period from 2025 to 2030 is expected to witness rapid revenue growth and market expansion for quantum integrated waveguide photonics, driven by technological advancements, increased funding, and expanding application areas across computing, communications, and sensing.

Regional Analysis: North America, Europe, Asia-Pacific & Rest of World

The regional landscape for Quantum Integrated Waveguide Photonics (QIWP) in 2025 is marked by distinct investment patterns, research intensity, and commercialization trajectories across North America, Europe, Asia-Pacific, and the Rest of the World. Each region’s approach is shaped by its technological infrastructure, government support, and the presence of leading quantum technology firms.

- North America: The United States and Canada remain at the forefront of QIWP innovation, driven by robust funding from both government agencies and private sector giants. The National Science Foundation and DARPA have significantly increased grants for quantum photonics research, while companies like IBM and Google are advancing integrated photonic chips for quantum computing. The region benefits from a mature semiconductor ecosystem and strong university-industry collaboration, accelerating the transition from lab-scale prototypes to scalable commercial solutions.

- Europe: Europe’s QIWP sector is buoyed by coordinated initiatives such as the Quantum Flagship program, which channels substantial EU funding into photonic quantum technologies. Countries like Germany, the Netherlands, and the UK are home to leading research centers and startups, including PSI and Quantum Delta NL. The region emphasizes open innovation and cross-border collaboration, with a focus on developing standards and interoperability for quantum photonic devices.

- Asia-Pacific: China, Japan, and South Korea are rapidly scaling up QIWP capabilities, leveraging national strategies and heavy investment in quantum R&D. China’s Chinese Academy of Sciences and Japan’s RIKEN are spearheading breakthroughs in integrated photonic circuits for quantum communication and sensing. The region’s manufacturing prowess and government-backed industrial policies are expected to drive down costs and enable mass production of QIWP components by 2025.

- Rest of World: While still nascent, QIWP activity is emerging in regions such as the Middle East and Latin America, often through partnerships with established players in North America and Europe. Initiatives like the Qatar Center for Quantum Computing are laying the groundwork for future participation in the global quantum photonics value chain.

Overall, 2025 will see North America and Europe leading in foundational research and early commercialization, while Asia-Pacific accelerates industrialization and cost reduction. The global QIWP market is thus characterized by regional specialization and increasing cross-border collaboration.

Future Outlook: Emerging Applications and Investment Hotspots

Quantum integrated waveguide photonics is poised for significant advancements in 2025, driven by both technological breakthroughs and a surge in strategic investments. As the demand for scalable, stable, and efficient quantum systems intensifies, integrated photonic platforms—especially those leveraging waveguide architectures—are emerging as a cornerstone for next-generation quantum technologies.

One of the most promising applications is in quantum computing, where integrated waveguide photonics enables the miniaturization and stabilization of quantum circuits. Companies such as Paul Scherrer Institute and Xanadu are actively developing photonic quantum processors that utilize waveguide-based architectures to achieve higher qubit counts and improved error rates. These advances are expected to accelerate the commercialization of quantum computing hardware, with market forecasts projecting a compound annual growth rate (CAGR) exceeding 30% for photonic quantum computing platforms through 2030, according to IDTechEx.

Another emerging application is quantum communication, particularly in the development of secure quantum key distribution (QKD) networks. Integrated waveguide photonics offers a pathway to mass-producible, chip-scale QKD devices, which are being piloted in metropolitan networks by organizations such as Toshiba and ID Quantique. The European Union’s Quantum Communication Infrastructure (QCI) initiative is also investing heavily in photonic integration to enable continent-wide quantum-secure communication by the late 2020s.

In the realm of quantum sensing, integrated waveguide photonics is enabling the development of ultra-sensitive sensors for applications in medical diagnostics, navigation, and environmental monitoring. Startups and research consortia, such as those supported by the National Science Foundation, are targeting breakthroughs in on-chip quantum sensors that leverage the unique properties of photonic waveguides for enhanced sensitivity and miniaturization.

Investment hotspots in 2025 are expected to cluster around North America, Europe, and East Asia, with significant funding flowing from both public and private sectors. Venture capital activity is intensifying, as evidenced by recent funding rounds for photonic quantum startups and increased participation from technology giants. Strategic partnerships between academia, industry, and government are also accelerating the translation of laboratory advances into commercial products, setting the stage for rapid market expansion in the coming years.

Challenges, Risks, and Strategic Opportunities

Quantum integrated waveguide photonics (QIWP) is poised to revolutionize quantum information processing, communications, and sensing by enabling scalable, chip-based quantum systems. However, the sector faces significant challenges and risks that must be addressed to unlock its full potential, while also presenting strategic opportunities for innovators and investors.

Challenges and Risks

- Fabrication Complexity and Yield: Achieving high-quality, low-loss waveguides and integrating multiple quantum components (sources, detectors, modulators) on a single chip remains a major technical hurdle. Variability in fabrication processes can lead to inconsistent device performance, impacting scalability and commercial viability. According to imec, yield rates for complex photonic integrated circuits (PICs) are still below those required for mass-market adoption.

- Material and Platform Limitations: The choice of material platform (silicon, silicon nitride, lithium niobate, indium phosphide, etc.) affects device performance, integration density, and compatibility with quantum emitters. Each platform presents trade-offs in terms of loss, nonlinearity, and integration with electronics, as highlighted by LioniX International.

- Quantum Coherence and Loss: Maintaining quantum coherence over integrated waveguides is challenging due to scattering, absorption, and fabrication-induced defects. Losses directly impact the fidelity of quantum operations, as noted by Nature in recent experimental studies.

- Standardization and Interoperability: The lack of industry-wide standards for quantum photonic components and interfaces hinders ecosystem development and supply chain maturity, as reported by EuroQIC.

- Investment and Commercialization Risk: The long development timelines and uncertain near-term market size pose risks for investors and startups, as outlined by Boston Consulting Group.

Strategic Opportunities

- Vertical Integration: Companies that develop proprietary fabrication processes and vertically integrate design, manufacturing, and packaging can achieve performance differentiation and cost advantages, as demonstrated by Paul Scherrer Institute.

- Hybrid Integration: Combining different material platforms and quantum technologies (e.g., integrating superconducting detectors with photonic chips) offers pathways to overcome individual material limitations, as explored by Xanadu.

- Early Standardization Leadership: Firms that help define and adopt standards for quantum photonic components can shape the ecosystem and secure early market share, as advocated by Connectivity Standards Alliance.

- Government and Defense Contracts: Strategic partnerships with public sector entities can provide non-dilutive funding and early application opportunities, as seen in initiatives by DARPA and the National Institute of Standards and Technology.

Sources & References

- MarketsandMarkets

- Paul Scherrer Institute

- Infinera Corporation

- Xanadu

- imec

- LIGENTEC

- ams OSRAM

- ID Quantique

- EUROPRACTICE

- Quantum Delta NL

- QuTech

- NICT

- IBM

- Thorlabs

- Lumentum

- IDTechEx

- Imperial College London

- Nature

- National Science Foundation

- DARPA

- Quantum Flagship

- Chinese Academy of Sciences

- RIKEN

- Toshiba

- Quantum Communication Infrastructure (QCI)

- LioniX International

- Connectivity Standards Alliance

- National Institute of Standards and Technology