- Rocket Lab USA’s stock surged over 700% in 2024, evidenced by its innovative approach to satellite launches and end-to-end space services.

- The company’s small payload launch vehicle, Electron, executed 16 flawless missions in 2024, enhancing Rocket Lab’s reputation and client trust.

- The Space Systems division’s substantial growth boosted revenues to $436 million, highlighting Rocket Lab’s market strength.

- Skepticism arises over potential delays in the Neutron rocket’s launch, impacting investor confidence and stock value.

- Neutron’s success is crucial, offering significant revenue potential per launch compared to Electron, pivotal for Rocket Lab’s financial future.

- Rocket Lab is at a crossroads; overcoming Neutron-related challenges could lead to expansive revenue growth and potential profitability.

- Investors should exercise caution due to the uncertain timeline and possible need for funding, which could dilute stock value.

- Long-term ambitions, including a potential satellite constellation, suggest further growth opportunities akin to SpaceX’s Starlink.

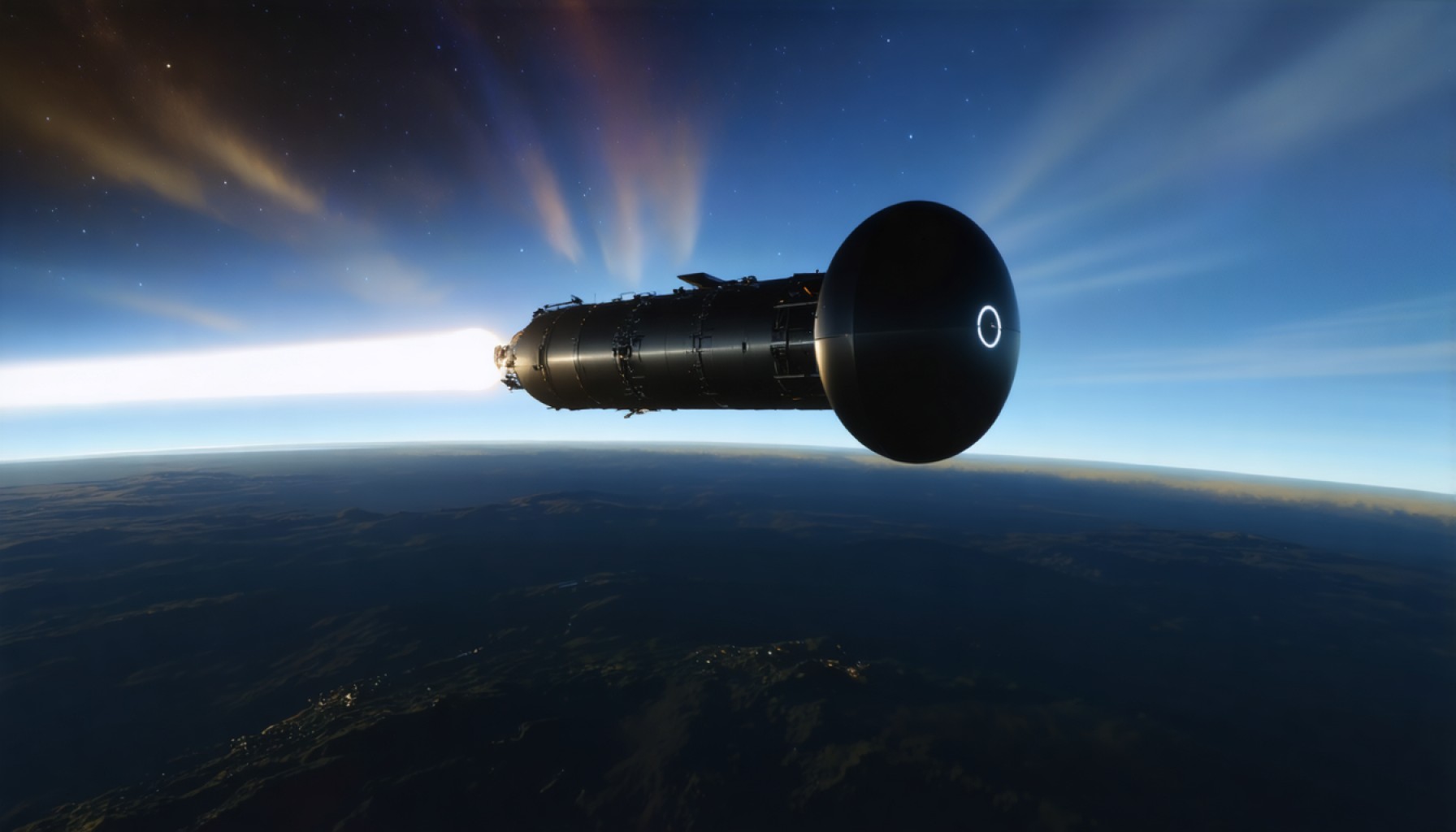

For a company aiming to send satellites and dreams beyond Earth’s grasp, Rocket Lab USA reflects that ambition right here on terra firma. Its stock, once sluggish, roared astoundingly upward over the past year. Sprouting from mere $4 sprouts in spring 2024, it shot past $30 in January, marking over a 700% leap. Investors pinned hopes on it as an agile competitor to SpaceX, buoyed by Rocket Lab’s continuous pursuit of innovation and expansion as an end-to-end space service provider.

Yet, as swiftly as fortunes rose, unease overcomes optimism—a pivotal turning point now shadows Rocket Lab’s ambitious trajectory. The once faultless sheen of promise dimmed as skepticism surrounding the Neutron rocket’s timeline sowed doubt. Analysts suggest a delay may loom over its anticipated 2025 debut due to the remaining development hurdles. Consequently, shares spiraled down 40% from their peak, urging the question on every investor’s mind: Is now the time to buy Rocket Lab stock?

The ascent began with Rocket Lab securing its niche in small payload launches. As one of the few private entities in North America pioneering reliable rocketry, Rocket Lab prides itself on Electron, its compact, steadfast workhorse. Throughout 2024, Electron achieved perfection, executing 16 flawless missions; its success illustrates not just astute engineering but the trust it built with commercial and governmental clientele.

Fueling Rocket Lab’s upward climb is a burgeoning Space Systems division. Thriving alongside Electron’s exploits, this branch cultivates launch payloads and netted $311 million in 2024, a formidable growth from 2023’s $172.7 million. The two segments collectively catapulted Rocket Lab to $436 million in revenue, consolidating its rank as one of the market’s fastest-growing entities.

Optimistic forecasts hinge heavily on the Neutron rocket—a behemoth compared to Electron. Propelling larger payloads, Neutron promises revenues of at least $50 million per launch against Electron’s sub-$10 million. Yet the clock ticks against Rocket Lab’s development sprint, with some experts projecting delays into 2026 or beyond, driven by complex build and launch infrastructures still under construction. Such setbacks could sap financial resources and investor confidence alike, pushing the company towards costly fundraising avenues that might dilute stock value.

Despite the turbulence, Rocket Lab’s impressive past performance and burgeoning reputation among industry peers weigh heavily in its favor. Its mastery of Electron launches and rapid expansion into space systems reinforce investor faith. Still, amid this landscape of promise and peril, the Neutron rocket’s uncertain timeline casts a substantial shadow.

For now, Rocket Lab stands at a critical crossroads. If the Neutron can overcome delays, it might catapult revenue growth and eventual profitability. Beyond its rocketry endeavors, whispers of aspirations to forge a satellite constellation akin to SpaceX’s lucrative Starlink could signal further ambitions. But for investors gauging today’s volatile tableau, caution may be wise. The current market cap implies Neutron’s assured success—a leap of faith that demands careful navigation until Rocket Lab clears the hurdles of time and technology. Until then, tempered patience might best suit those eyeing the stars with Rocket Lab.

Should You Invest in Rocket Lab? Key Insights, Forecasts, and Expert Opinions

Overview

Rocket Lab USA has captured the imagination of investors with its significant advances in space technology and an impressive stock surge in 2024. However, the company now finds itself at a pivotal crossroads, marked by both promising prospects and looming challenges. Here’s a deep dive into Rocket Lab, providing additional context, expert insights, and actionable recommendations.

How Rocket Lab Stands Apart

1. Innovative Approach to Space Launches:

Rocket Lab has carved out a niche in the small payload launch market with its Electron rocket, which boasts a track record of flawless missions in 2024. This specialization has built trust among commercial and governmental clients.

2. Expanding Space Systems Division:

The company’s growth also stems from its burgeoning Space Systems division, which reported a remarkable revenue boost from $172.7 million in 2023 to $311 million in 2024.

Pressing Questions and Expert Opinions

Is the Neutron Rocket Facing Delays?

Yes, the ambitious Neutron rocket, designed for larger payloads, is pivotal to Rocket Lab’s future revenue. However, development hurdles could push its debut to 2026 or beyond, impacting investor confidence and stock value. Experts suggest that investors need to watch closely for updates on its timeline.

What Are the Financial Implications of Delays?

Potential delays in Neutron’s launch could strain Rocket Lab’s financial resources, possibly necessitating fundraising that might dilute stock value.

Could a Satellite Constellation Be on the Horizon?

There are whispers of Rocket Lab aiming to develop a satellite constellation, similar to SpaceX’s Starlink, which could significantly enhance long-term revenue streams. Yet, details remain speculative at this stage.

Market Forecast and Industry Trends

– Space Industry Expansion: The commercial space industry is expected to continue its rapid growth, with increased private and governmental investments. Rocket Lab’s established presence positions it well to capitalize on these trends.

– Competitive Landscape: As one of the few private companies in North America capable of reliable rocket launches, Rocket Lab remains a strong competitor to giants like SpaceX.

Pros and Cons of Investing in Rocket Lab

Pros:

– Proven reliability with Electron missions.

– Strong growth in revenue from the Space Systems division.

– Potential for new revenue streams from future projects like Neutron and a satellite constellation.

Cons:

– Potential delays with Neutron affecting timelines and finances.

– High investment risks due to market volatility and industry competition.

Actionable Recommendations

– Stay Informed: Closely monitor Rocket Lab’s announcements concerning Neutron developments and financial performance.

– Risk Management: Consider the high-risk nature of space investments in your portfolio diversification strategy.

– Long-Term Vision: For long-term investors, the potential for continued innovation underscores the importance of maintaining a watchful eye on Rocket Lab’s strategic initiatives.

Conclusion

Rocket Lab’s journey demonstrates both incredible potential and the risks inherent in the space industry. With strategic patience and informed decision-making, investors can navigate this volatile landscape, bearing in mind the company’s long-term prospects and innovations.

For further exploration, visit Rocket Lab’s homepage to keep abreast of their latest updates and developments.