- Visionary investors are increasingly attracted to the metals industry, with billionaires like Warren Buffett and Bill Gates showing interest due to its pivotal role in technology and renewable energy.

- Metal stocks offer strategic investment opportunities amidst volatile market conditions, with significant interest despite market fluctuations in February and March.

- Copper and nickel, crucial for future technologies, are in high demand, with copper recently peaking at $5.24 per pound due to economic policies and tariffs.

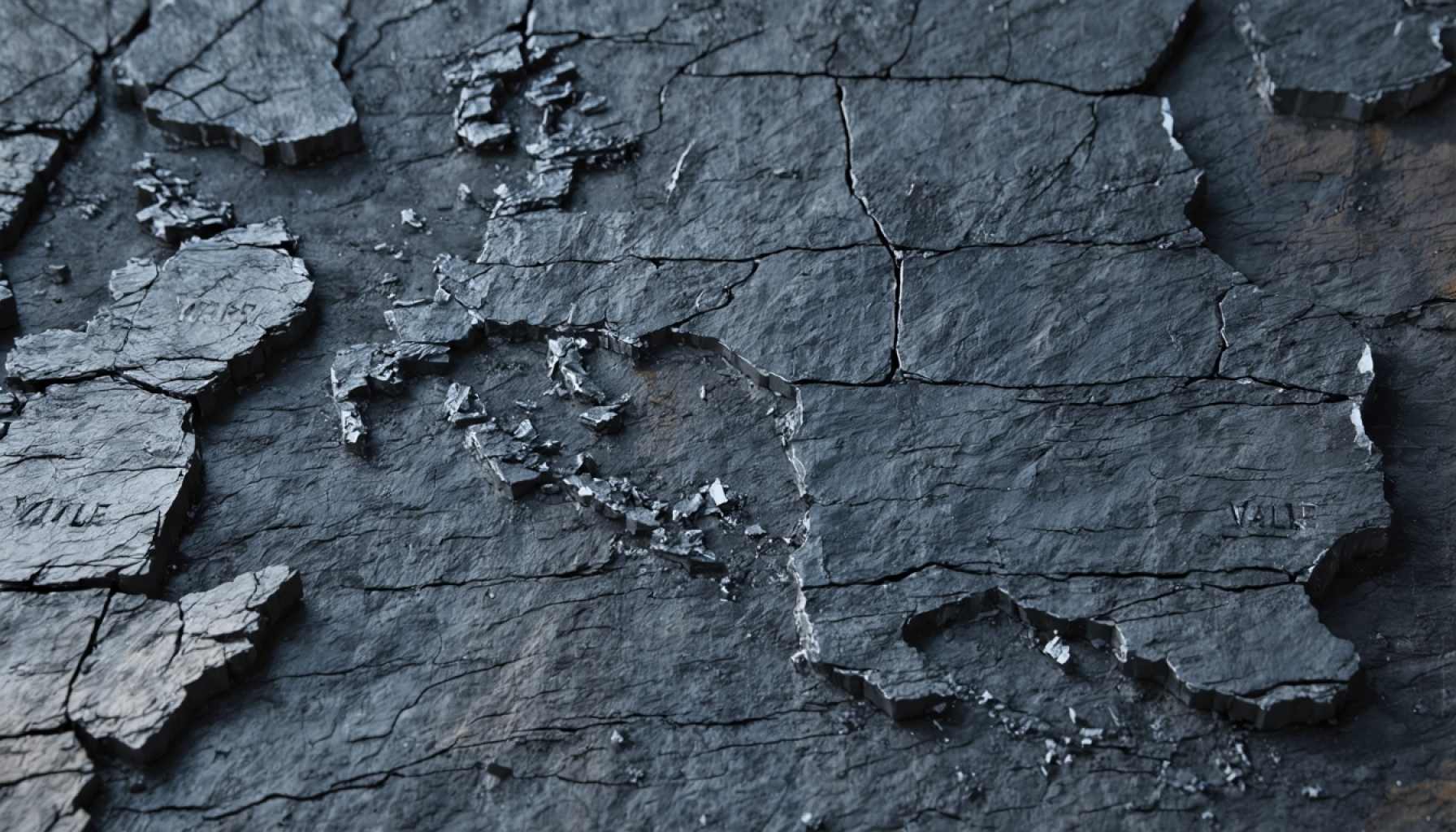

- Vale S.A., a prominent player in the sector, faced recent financial challenges but remains strong with robust production and progressive strategies, including a share buyback initiative.

- Analysts have a positive outlook on Vale, with potential for growth driven by plans to boost copper production and a significant $12.2 billion investment.

- The shift towards sustainability and the necessity for key minerals present lucrative opportunities in the metals market, making Vale a noteworthy investment.

A glimmer of opportunity beckons visionary investors toward the heart of the metals industry. It’s an enticing prospect that has captivated the wallets of billionaires from Warren Buffett to Bill Gates. Metals are the backbone of our world—a silent force holding up skyscrapers, powering our devices, and soon to drive the engines of renewable energy. With the world teetering on the cusp of a new technological era, metals like copper and nickel have become the treasures of tomorrow, and few companies understand this better than Vale S.A. (NYSE:VALE).

In the tumultuous currents of the stock market, where highs and lows are as unpredictable as a storm-tossed sea, metal stocks stand as havens of potential wealth. For the nimble investor, they are not just commodities; they are a strategic play on global economics. The U.S. market, despite recent volatility, reflects this burgeoning interest. February witnessed milestones with record highs, though March brought a sobering correction. Yet, the turbulent waters have failed to deter the rising tide in the metals sector. Copper surged to its zenith at $5.24 per pound, a surge sparked by impending tariffs and China’s aggressive economic policies.

Gold, that eternal symbol of wealth, continues to allure with a 14% climb in futures and expected growth in the years ahead. Savvy investors, guided by the strategies of billionaires, are eyeing more than just gold. They’re casting their nets wider, seeking value in silver and rare earth metals—prizes integral to future technologies.

Turning our gaze to Vale S.A., this Brazilian behemoth stands tall in the global supply chain. Though recent quarters revealed financial challenges, including a $694 million loss attributed to impairments in Canadian operations, Vale’s strategy remains robust. The company heralded its commitment to shareholders with dividends and an ambitious share buyback scheme. Its enviable iron ore production hit almost 328 million metric tons in 2024, displaying resilience and operational strength.

Analysts paint a promising picture for Vale, highlighting a price target increase and an “Outperform” rating from RBC. The consensus suggests an “Overweight” rating, with potential gains on the horizon. Vale’s sights are firmly on the future; plans to double copper production are well underway, and a $12.2 billion investment into its Carajás complex underscores a steadfast resolve to expand and excel.

The metals market isn’t just about numbers and outputs—it’s a reflection of changing times. As nations pivot towards sustainability, the demand for essential minerals will soar, creating corridors of opportunity for those ready to venture forth.

Amidst the clamor for AI and tech stocks, Vale stands as a testament to the enduring allure of metals. It reminds us that the road to riches is often paved with elements of the earth, waiting for those with the foresight to dig deeper. As the winds of change blow across the metallic landscape, the opportunistic shall find fortune, driven by the insatiable ambition of billionaires betting big on the future.

In the narrative of metal investments, Vale S.A. emerges as a compelling protagonist. For investors cognizant of the trends and tracks, the story is far from over—it’s only just beginning.

Why Billionaires Are Betting Big on Metals: Discover the Next Gold Mine

The Future of Metals: From Infrastructure to Sustainability

The metals industry is more than just mining and production; it represents the evolution of technology and infrastructure. As the world transitions to renewable energy and sustainable practices, metals like copper, nickel, and rare earth elements are becoming increasingly crucial. Copper, for instance, is integral to electrical applications and the burgeoning electric vehicle (EV) market due to its excellent conductivity.

Exploring Vale S.A.’s Role in the Metals Sector

Vale S.A. is a leading player in the metals market, especially noted for its iron ore and nickel production. Despite facing a loss due to impairment charges, the company demonstrates resilience with a significant iron ore output of 328 million metric tons in 2024.

Vale’s strategy is not just about damage control; it is about future-proofing its operations. The planned $12.2 billion investment in the Carajás complex is a strategic move to enhance production capabilities and meet future demand. This aligns with the global shift towards electric vehicles and renewable energy, which require significant metal resources.

Industry Trends: The Rise of Sustainable Investments

Investors are increasingly looking at sustainable and eco-friendly ventures. Metal recycling and sustainable mining practices are becoming important factors for companies to attract investors. The global interest in reducing carbon footprints is leading to a surge in demand for sustainably sourced metals.

Pros and Cons of Investing in Metal Stocks

Pros:

– High Growth Potential: Metals like copper and nickel are expected to see increased demand due to their applications in technology and sustainable energy.

– Diverse Applications: Metals are used in various industries, which buffers against market volatility.

– Strong Global Demand: As developing countries industrialize, the demand for metals remains strong.

Cons:

– Market Volatility: Factors like geopolitical tensions and trade tariffs can impact prices.

– Environmental Concerns: Mining activities face scrutiny regarding their environmental impact.

– Financial Risks: Companies like Vale can be affected by operational and impairment charges, as seen in its Canadian operations.

How to Capitalize on Metal Investments

1. Research and Diversify: Broaden your portfolio by including a variety of metal stocks. Consider not just the large companies like Vale, but also smaller firms focused on specific metals.

2. Monitor Global Trends: Keep an eye on industry trends, such as shifts toward renewable energy, which can influence metal demand.

3. Stay Informed: Follow expert analyses and price targets. Analysts currently recommend an “Overweight” rating for Vale, with potential upward revision of share prices.

4. Consider ETFs: Exchange-Traded Funds (ETFs) focused on metals can offer exposure to the sector with reduced risk.

5. Evaluate Sustainability Efforts: Investing in companies with sustainable practices can yield long-term benefits and align with global trends.

Conclusion and Quick Tips

The metals market, driven by technological advancements and sustainability trends, offers lucrative opportunities for investors. By understanding the industry dynamics and carefully selecting investments like Vale S.A., investors can potentially capitalize on future growth. To begin, start by diversifying your portfolio, focusing on sustainability, and staying informed about global market trends.

For further insights into investments and market trends, visit Bloomberg and CBC.